FreeTaxUSA IRS free file edition is a website which lets you file your tax return online for free if you meet the eligibility criteria of the website. The website allows you to file both federal and state tax returns for free if you qualify. If you do not qualify though, you can still file your tax return for a nominal amount. Earlier we have covered some websites which also let you file free tax return online if you qualify like 1040.com, H&R Block, TaxAct, TaxSlayer, TurboTax, ezTaxReturn, 1040Now.net, and Online Taxes at OLT.com. You can try out any of these websites for your tax return filing, each website has a different eligibility criteria for filing a free return.

FreeTaxUSA is part of the IRS free file alliance and you can trust the website as well. Open the website using the link given at the end of this article. You will see a screen like the one shown in the screenshot below.

On the home page of the website click on the see if you qualify button, to check if you are eligible for the free filing option. You will be asked if your AGI (adjusted gross income) is less than $35,000 or if you qualify for Earned Income Tax Credit, or if you are active duty military last year. If your answer is yes to any of the questions, then you qualify for the free return.

Click on the start now button, and you will be asked to create an account with the website. For creating an account you will be required to enter a username, password, email ID, and phone number. Then answer some security questions, in case you ever forget your password, then these questions would be used to identify you and reset your password.

Now you will be asked if you want to export your last years return. Click continue, and you will be asked to fill in some personal information like name, occupation, social security number, birth date, address, etc. Then choose a filing status out of the given ones, as can be seen in the screenshot above. In case you do not know which one to choose, use the help option given at the bottom of the page.

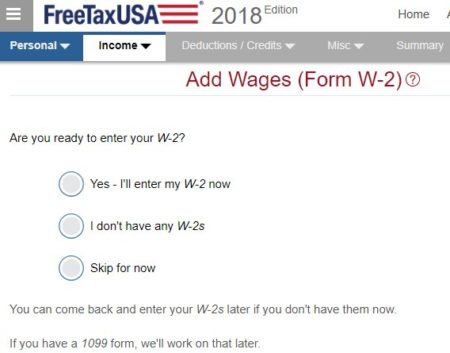

After a summary page of your personal information, you will be taken to the income section. The first section is entering your W-2 information. Enter the information as given in your W-2. Add as many W-2’s as you have. At the end you will be shown a summary of your W-2 income. Then other income categories will be shown to you. You can go through each one and see if any of them is applicable to you. At the end you will be shown a summary of your income section.

Then comes the deductions section. You will be asked if you made any IRA contributions, answer accordingly. Then you will be shown your standard deduction which is $12,000. In case you want to go with itemized deductions then you can enter information such as medical expenses, taxes paid, mortgage interest, donations to charities, etc. Then choose the higher number out of standard and itemized deductions and go with that.

Then you will be asked some questions about your health insurance coverage for the year. Next you can add in some expenses you had like college tuition expenses, student loan interest, educator expenses, home energy credit, child care expenses, job expenses, moving expenses, jury duty, alimony paid, etc.

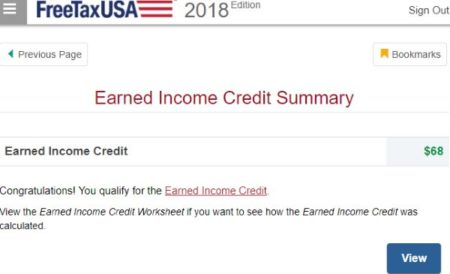

Earned income questions will be asked to determine if you qualify for this credit. At the end of the questions you will be shown if you qualify for this earned income credit or not.

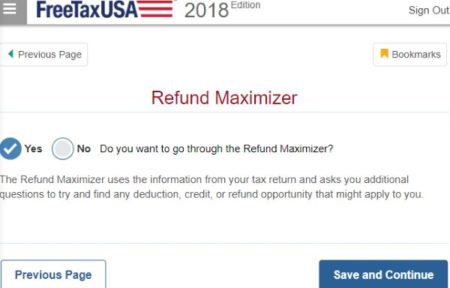

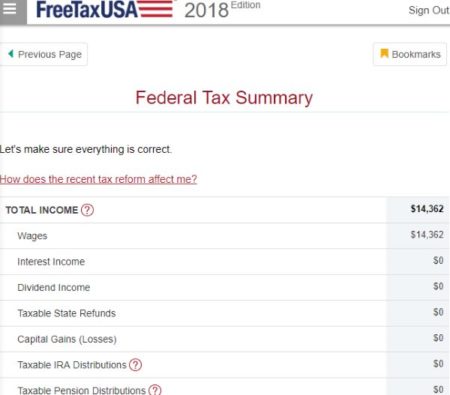

Then you will be taken through some miscellaneous forms and topics. Go through them to see if any of them is applicable to you. Then you will be shown a refund maximizer, you will be asked additional questions if you choose this option to maximize your refund. After you go through everything you will be shown a federal tax summary.

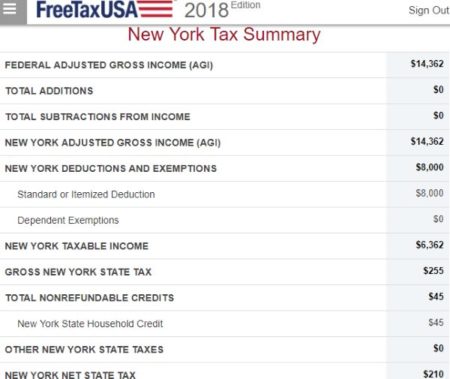

Now we move on to the state tax return. Click continue and you will be asked questions about your state of residence for the year, and some additional questions need to be answered. Then you will be shown itemized deduction for your state return. Similarly, you can claim any credits for your state return as well. A state return summary will be shown at the end of this section.

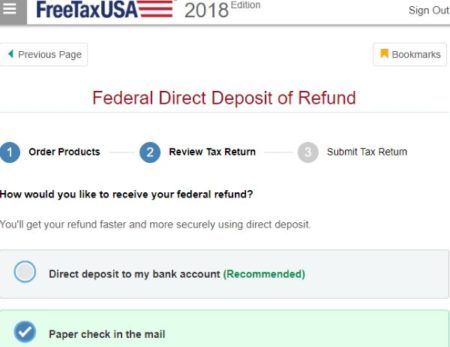

Now you will be shown if you qualify for a free tax return or not. If you do then you can proceed with choosing a refund option. You can get your refund directly deposited to your bank account, or you can receive a paper check at your mailing address. Choose a refund option for both your federal and state tax returns.

Then you will be asked to enter a valid state ID. You can proceed without a state ID as well, but that would mean your return would take more time to get processed. Then review your return and choose if you want to efile your return or mail in the tax return.

The final step is to choose a PIN number which will be used as your electronic signature for filing the return online. Choose a PIN number and submit your return to IRS for processing.

Conclusion:

FreeTaxUSA is a good website to file your taxes with this year. The website has a nice interface and the questions asked are quiet simple to understand. Help is given wherever required. So if you are planning to file your tax return online, then do give this website a try.

Check out FreeTaxUSA website here.