With this first article we are starting a series of articles where we will be finding websites that let you file your taxes online for free in 2019. IRS has started accepting returns for the year 2018 and everyone wants to know if they would be getting a refund or they need to pay. With all the changes that have been made in the tax laws this year, people are anxious to know how they will affect their tax refunds. Remember your 2018 tax returns are due by 15th April 2019.

Let’s start this series with the most basic option to free file which is IRS Free File service. IRS has partnered with 12 tax software companies like TurboTax, H & R Block, TaxSlayer, TaxAct, etc. to provide you this free file service.

Note: The main point to keep in mind is your income needs to be $66,000 or below to qualify for the free file option.

Let’s see how to use this Free File Service by IRS

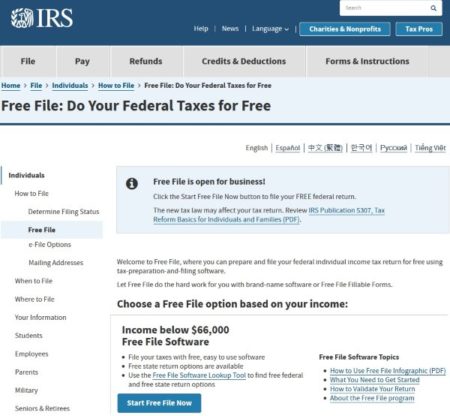

First of all go to the IRS website using the link given here. You will see a page like the one shown in the screenshot below.

This is the IRS Free File program page, giving you information about free return requirements. From here select the free file software lookup tool link. This page is where all the tax companies are listed who have partnered with IRS free file program. Each tax software company has listed their criteria for free filing of taxes. Some tax companies even offer you free state tax returns while some charge you a fee for state tax returns.

The above screenshot shows the free file software lookup tool page. You can either browse through the page to choose which tax company you want to file your return with or you can try the lookup tool. In this tool, you will need to answer some questions about your income, age, state of residence, etc. Then this tool will suggest which tax company you should go with.

Let’s start with the first one in this list 1040.com FreeFileEdition. You can see their criteria for a free return. You can access their website from the link below.

1040.com FreeFileEdition

1040.com FreeFileEdition home page can be seen in the screenshot above. To start with the website you need to choose the login option given at the top right side. To create a account click on the sign up link. Enter a email, username, and password to create your account. You will be shown your dashboard with a Let’s begin button.

First of all you would need to decide on your filing status. Like are your filing as single, married filing joint, married filing separately, head of household or qualified widow(er) with dependent child. If you know how you are filing then choose that option, otherwise click on the link “help me decide” right next to this box.

Now follow the questions as they appear on your screen. You will be asked if you can be claimed as a dependent on someone else’s return, answer accordingly. Then fill in your full name, social security number, birth date, etc. Once this section is over you will move on to the next section which is federal taxes.

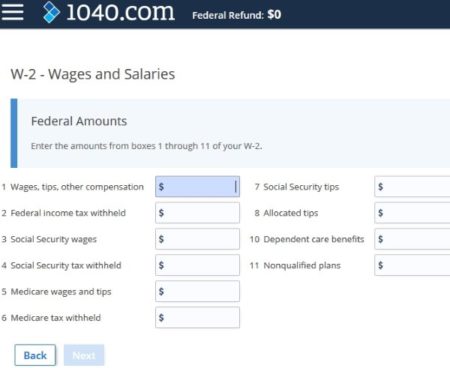

In the federal taxes section you start by entering your W2 form details. This section looks like the below screenshot. Just enter all the details as shown in your W2 form.

Once you have entered all the details, you will be taken through other income section to determine if you had any other income like

Interest income: Usually reported on a 1099-INT form which is interest income received from a savings bank account.

Unemployment compensation: is form 1099-G which is given if you have received unemployment income during the year.

Retirement Income: Usually refers to funds received from pension account, 401K, IRS, profit sharing, etc. These are reported on a form 1099-R.

Some other income sources could be business income, income from gambling or lottery, etc. Just follow the questions appearing in front of you to determine if you received any of these.

Then comes the section on dependents, deductions, credits, health care, etc. Follow the step by step questionnaire given on the website. Where ever there are questions that you don’t know, there will be a link to make you understand what that question is all about.

At the end of the return you will have your tax refund or tax due amount displayed to you, as seen in the screenshot above. If you are done with your federal return click on the button provided. In case you also have a state return to file, click on add a state return on the next screen.

When you are ready to file, you will have options whether you want to e-file the return, or send in a paper return. If you are getting a refund then you need to provide information about how you would like to get a refund. The refund can be deposited directly in your bank account or you can also choose for a check to be mailed to your address.

If you qualify for a free federal return, then the website also offers free state returns for some states.

Conclusion:

1040.com FreeFileEdition is a good way to file your taxes for free, if you qualify the free file criteria. The online tax filing option they have is secure and safe. You do not have to worry about your data being leaked out. The website is part of the IRS free file alliance, so it is trustworthy. Check out this website for filing your tax return this year.

Check out this website here.