1040NOW.NET is a website to file tax online for free. This website is part of the IRS free file alliance, so you can trust this website. The website offers you a step by step guide into filing your taxes. Earlier we have covered some other websites which offer you free tax filing like 1040.com, H&R Block, TurboTax, TaxSlayer, TaxAct, ezTaxReturn, and Online Taxes at OLT.com. Like the other websites that we have covered, this website also has a qualifying criteria for filing free tax returns. The eligibility criteria is given on the home page of the website.

If your adjusted gross income is less than $66,000 and you live in one the states mentioned on website, then you might qualify for a free tax return. Let’s check the website out, by going to its home page. The link for the website can be found at the end of this article.

If you qualify the conditions mentioned on the home page of this website, then you can start with a free return, by clicking the “start my free tax return” button. As can be seen in the above screenshot.

On the next screen choose start a new account. Now you will be asked to enter a username, password, select a security question, and email address. Next screen will ask you to accept the agreement of the website and enter a pin number sent to your registered email id.

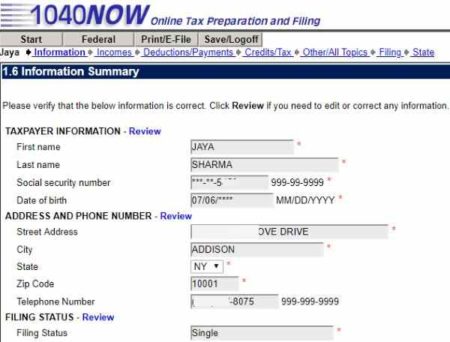

Then you will be shown what all is new with taxes this year, just some brief information. Then you move on to the personal information page where you have to enter your name, address, birth date, social security number, occupation, etc. At the end of this section a summary of your personal information will be shown, as seen in the screenshot above.

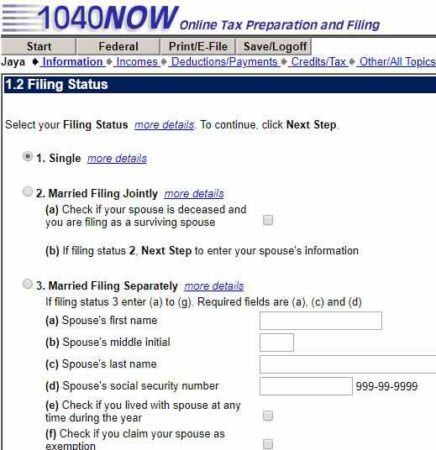

You will now be asked to select a filing status for yourself. This can be seen in the screenshot above. You can take help of the links given in front of each filing status or choose the one which is applicable to you. Enter any dependent information, if you have any.

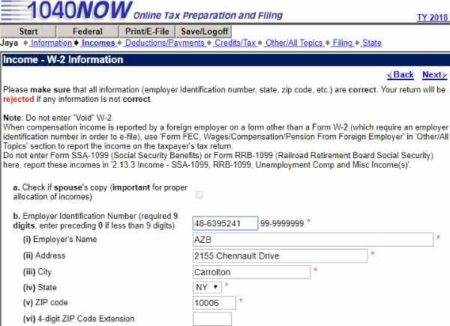

Now we come to the income section, where you can start by entering your W-2 information by clicking on the your new copy link at the bottom. This will open a W-2 form, as shown in the screenshot above, where information can be filled in as asked. You can enter your wages, tax withheld, employer EIN, etc. Then move on to the next section which is other income.

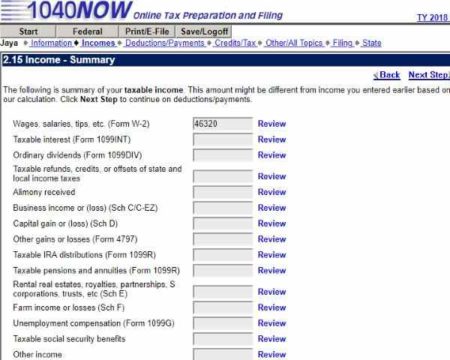

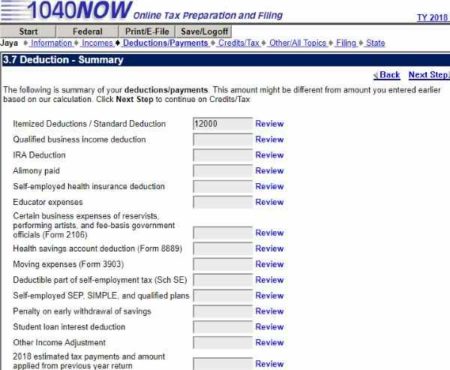

In other income you will have fields like interest income, dividend income, distributions from IRA account, business income, capital gains, unemployment compensation, etc. At the end of this section a income summary will be shown, as can be seen in the screenshot above. Then you will be asked to choose between itemized deductions or standard deduction. If your itemized deductions are more than the standard deduction then go with it otherwise go with the standard deduction.

In itemized deductions you can enter expenses like medical expenses, interest paid, employee expenses, contributions made to IRA account, alimony paid, educator expenses, etc. The deductions summary will be shown at the end of this section, as shown in the screenshot above.

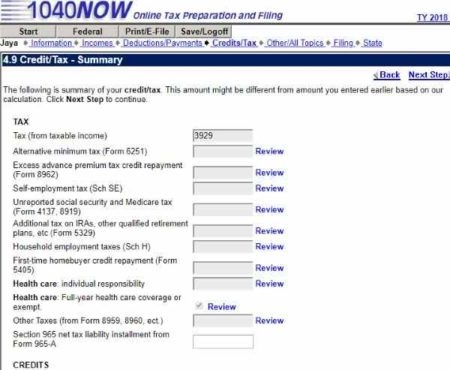

Moving on to child and dependent care expenses and earned income credit. Answer the questions as asked, and see if you qualify for these credits. Then go through some other credits which you might qualify for. The credits summary will be shown at the end of this section, as seen in the screenshot above.

Then comes the healthcare section, where you need to answer some questions about your health coverage for the year. Answer accordingly. Now click on go to next step, and you will be shown that your federal return preparation is complete and you can move on to see if you qualify for the free return.

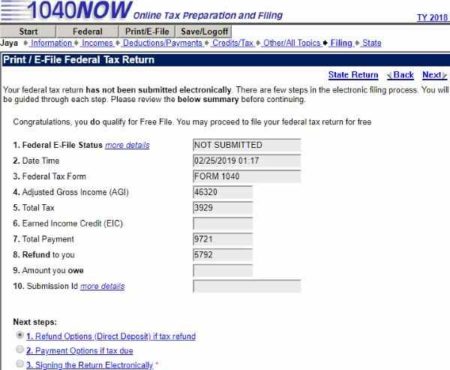

If you qualify for the free return, it will be mentioned on top of the page. Now you can also go ahead and add a state return as well. Just go through the questions being asked and answer as applicable to you. The state return might not be available for free filing. Once you are done with that, click on choose how to get your refund.

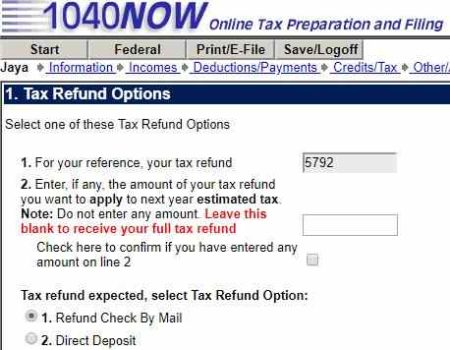

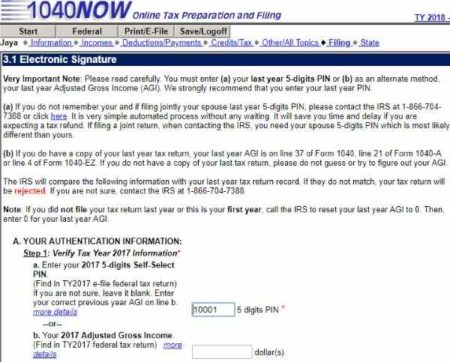

You get two options, you can get your refund directly deposited to your bank account or you can have a paper check mailed to your address. When you go to the next step you will be asked to choose a pin number for efiling your return.

Once you provide the pin number, it will be used as your digital signature. Now you are ready to efile your federal tax return. Go ahead and submit the return to send it to IRS online for free.

Conclusion:

1040NOW.NET is a nice website to file your tax return online for free. Do remember that the website has a qualifying criteria if you want to file a free return. The conditions for qualifying for a free return are given on the home page. Only if you meet these conditions your are able to file your return for free.

If we talk about the interface of this website, then it is not as nice as the other websites that we have covered for tax filing online. Page full of text and questions might look complicated to people. Otherwise, it is a good website to file your tax return.

Check 1040NOW.NET website here.