Works with: Microsoft Office, OpenOffice

Vertex42 has an interesting free Excel based Debt reduction calculator. This excel lets you determine the best strategy to payoff all your debts, and calculate the exact payments to be paid, and which debt to be paid off first. This Excel based Debt Reduction Calculator is totally free. You do not need to install anything, and there is no macro to run.

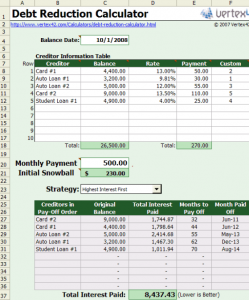

To start with this Free Excel based Debt Reduction Calculator, you first enter all your debts in this excel. You can specify all kinds of debts in this: Credit Card Debt, Auto loan, Student loan, personal loan, and any other debt. After that, you specify interest rate of each debt and minimum payment required to be paid for each. This is the minimum payment that you financial institution has stipulated for your debt.

Once you have entered this info, you need to enter the maximum monthly payment that you can make towards all of your debts combined. Once you have specified this, Free Excel based Debt Reduction Calculator will calculate the “snowball”, or extra payment by finding a difference between your total minimum payments that you must pay each month, and this maximum amount that you can pay each month. For example, if you have one credit card debt with minimum monthly payment of $100, and another debt with minimum monthly payment of $50, then total minimum monthly payments for month are $150. If you can actually make payments of $175 per month, then your initial snowball will be $25.

Based on this extra payment, Free Excel based Debt Reduction Calculator will give you option to reduce your debt based on various debt reduction strategies.

Here are some of the strategiess available for Debt reduction in this Free Excel based Debt Reduction Calculator:

- Debt Snowball (Lowest Balance First): This strategy aims to boost your morale by quickly paying off some of the debts. It starts with the debts that have lowest balance, and aims at paying that off first. This is good for those who have too many debts. This strategy would help them in getting rid of smallest debts first, and then focus on the bigger ones.

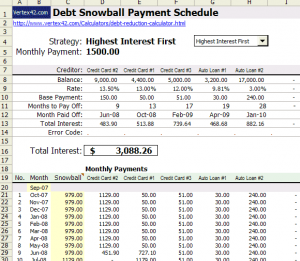

- Highest Interest First: Financially speaking, this is actually the best strategy for Debt Reduction. It aims at paying off those loans first that carry highest interest rates, like credit card debts. Your total outflow of money will be lowest in this strategy, simply because you keep paying highest interest loans first.

- User Specified Order: You can also choose to decide yourself about the order in which you need to pay off your debts.

Once you have decided your strategy for Debt reduction, this Free Excel based Debt Reduction Calculator will show you the exact payments that you need to make for each debt in each month to eliminate your debts. You can experiment between various Debt reduction strategies to see the payment plan for each, and see what works best for you. This also shows a Snowball Growth Chart to show how your interst dues decreases over time.

This Free Excel based Debt Reduction Calculator is very well designed, and is extremely easy to use. More importantly, it helps you in getting rid of your debts, which is great. This works with both Microsoft Office, as well as OpenOffice. Love it!

Download links, and Video Tutorials at the end.