BudgetPulse is a free online budget management service where you can manage your monthly financial transactions, income, expenses and overall cash flow. Next to all the standard features that you’d expect from an online money management service, like creating expense categories, setting budgets for each expense type, statistics with charts and so on, BudgetPulse also supports both data export and import from third party money management software like Quicken and Microsoft Money.

Similar software: iFreeBudget, Money Manager Ex, PL Cash.

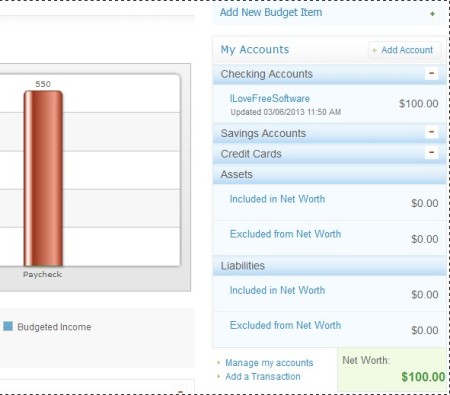

Screenshot above shows us the control panel of BudgetPulse. Even though it has a lot to offer, it’s not particularly complicated to use. Dashboard is where you’re gonna see overview of all your accounts, balances, assets, etc. Nice looking line chart with coloring for amount spent and amount left of the planned monthly budget can help you visualize your monthly expenses better. Toolbar at the top holds all the important personal finance management modules, like transactions, budget, accounts, charts and even goals. Key features of this free online budget manager are:

- Web based – all the tools and information are available online

- Manage multiple account – checking, savings, credit cards, assets, etc.

- Supports OFX, QFX, QIF and CSV import and export – Quicken, Microsoft Money

- Expense and income categories – for categorizing your transactions

- Charts – detailed statistics and reports on you financial activity

- Goals – add goals to your budget – money saving for new car, for example

- Free and very simple to use – setup your budget very quickly and easily

How to keep track of your monthly income and expenses with BudgetPulse

If you’re already using one of the supported personal finance software like Quicken and Microsoft Money, you can import data from there by clicking on Tools and following the import wizard. Backups can also be created there. All those who are starting from scratch, should open up the Budget tab from the menu at the top.

Budget is of course only for creating the monthly budget, but you can also create various different accounts where money’s gonna be saved or from where it’s gonna be paid, credit card account, checking and so on. You’re not actually connecting to your bank account, don’t worry. Controls are available in the right sidebar, while on the left you’re gonna see graphical chart of the budget expenses and income. Click on the Add New Budget Item or Add Account, depending on what you’re interested in adding.

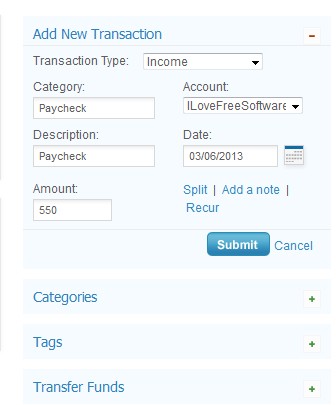

Open up the Transactions tab to add new transactions, both expenses and income can be added there. Once you’re done with that, move to the dashboard.

To view the budget status, click the Budget tab, for cash flow view, select Cash Flow of course. This is where you can see all the transactions and check on the overall status of your accounts, see image above.

Conclusion

BudgetPulse offers a lot of useful features and tools for managing money and budgets. It’s easy to use, you won’t need a long time to get the hang of things and best of all, it’s completely online. Some of the features we haven’t even mentioned, like for example the fact that you can add recurring payments, to automate things. Give this free online personal finance service a try and see how it goes.