OptionMatrix is a free financial derivative calculator for Linux and Windows to calculate, in real-time, various different types and models of derivatives. These financial instruments are pretty much all you hear about whenever you start listening to financial news reports, and with OptionMatrix its possible to calculate the values of derivatives that you trade in easily.

You may also try Yodlee Money Center, BillBaba, and Free Money Manager reviewed by us.

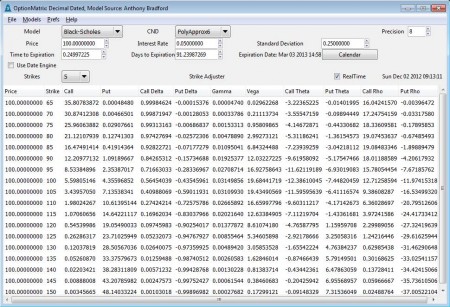

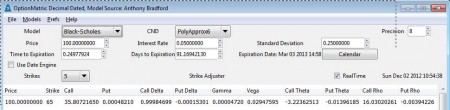

Interface of this free financial derivative calculator can be seen in the image above. When it comes to usability, if you understand what a derivative and all the jargon associated with it is, OptionMatix becomes very simple to use. At the top we have majority of settings that are important for setting up the derivatives calculations, while the rest of the window is where you can check the changes that are happening to the derivatives that you’re calculating.

Key Features of this Free Financial Derivative Calculator:

- Works with spreads, bonds, cash flow editing, has term structures.

- Decimal date to real date translations and vice versa.

- Configurable options expiration date engines.

- Built-in full featured calendar is available.

- Free and available for both Linux and Windows.

Derivatives are very complex thing to understand, but the basic explanation of what they are would be contracts made between two entities which are agreeing that at a future date one of the parties involved will perform payments under conditions specified in the contract. Here’s how you can keep track of and calculate derivatives with this free derivatives calculator for Windows.

How to Calculate Derivatives with OptionMatrix?

Derivatives calculations are going to start right away after you start OptionMatrix and they are going to keep getting calculated with time. What you should do after starting the application is to go through the menu at the top.

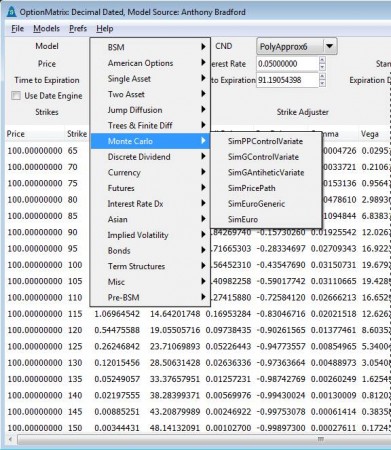

Good place to start setting up things would be clicking on the Model drop down menu, to select the type of derivative calculation model that you want to use. Over 130 different models are available, some of them are BSM, American Options, Single Asset, Bonds, Asian, Futures, Currency, and so on. When you’re done setting up the model, fill out the numbers.

Fill out the price, interest rate, standard deviation, precision, and everything else that’s offered. Numbers are going to change all the time down below. You won’t have to click on anything to start the derivative calculation. The numbers are going to change down below all the time, and you can check various different information like call, put, deltas and everything else that you might need calculated.

Conclusion

OptionMatrix is a very useful tool if you are dealing with derivatives on a daily basis. You can use it to calculate the value of the derivatives that you’ve invested in, and that way stay up to date with all the important changes that are going to be happening to the derivatives that you’ve invested in. Calculations are being made all the time, so you just need to set up the options in the menu above and the changes should start being applied right away.