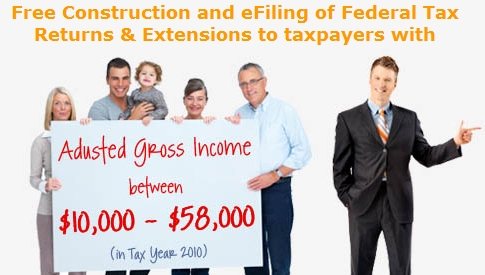

FileYourTaxes.com is a free federal return filing website. You can file your federal return for free if you Adjusted Gross Income (AGI) is between $10,000 and $58,000 and you live in one of the following states: AL, AR, AZ, CA, CO, CT, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MO, MS, MT, NC, ND, NE, NJ, NM, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, VT, WI, WV, WY and DC.

State returns are chargeable and can be e-filed for an additional $23.50 along with Free File Returns. Before you begin filing check the link “Forms Supported”. It will tell you all the forms that are supported by the website. So you will know if the forms you will need are supported by the website or not, and will help you in deciding your filing requirements accordingly.

The website offers two levels of customer service automated and personalized. Automated service includes questions and answer webpages, automated emails etc. Personalized service is not included with the free return. But in personalized service you can ask questions related to your return from the customer care agents.

How to File Tax Return on FileYourTaxes.com:

- New users will be required to create an account and sign in.

- After signing in, follow the interview process and answer all tax related questions.

- At the end of the interview process, you will know your refund amount and would be asked to review the information.

- At last you can go ahead and e-file your return.

The website also allows you to file free extensions. Extensions give you extra time to file your return, in case you do not have all your papers with you and are not ready to file by the end of tax season. Typically an extension gives you 6 months more to file your return.

The website also offers state returns for a charge. Check the Supported States link to see if your state is supported for a e-file. In case you do not qualify for the free return, check the pricing link to know how much fee you will have to pay. If you have filed your return with the website, they have a option for checking your e-file status. When you want to check the status of your e-file, just log in to your account and the latest status of your tax return will be shown to you.

Also check out other free tax file software, including, TurboTax free, Taxact Free, and Jackson Hewitt Free.

The website also allows you to take free prints of your online tax return for up to 6 months later from the date that you filed. With the online e-filing users have the option to get the refund directly deposited into a bank account. All you would need is a routing number and account number for the bank. Same goes if you owe money to the IRS. Instead of sending a check to the IRS, you can just give a account number, routing number and the date you want the account to be debited. This is the safest way to pay the amount due, as you won’t have to worry about your check getting lost in the mail.

FileYourTaxes.com is a member of the IRS free file alliance. So you can be sure that the website is safe and secure. The website is easy to navigate and simple to understand. Give it a try, you can always prepare your return for free and there is no obligation to file in case you are not satisfied.