This post covers a free startup funding simulator to understand modern fundraising. Funding plays a crucial role in the success of startups. It provides the necessary financial resources for startups to develop and expand their business, hire employees, and bring their products or services to market. Startup funding typically comes from a combination of sources, including friends, angel investors, venture capitalists, and crowdfunding. Each funding round generally has a specific purpose and can impact the startup’s growth and development in different ways.

Understanding the complexity of startup fundraising is not that simple. With various funding rounds, valuations, and options, it can feel like navigating a maze. Funding Simulator is a tool that aims to simplify this process. It lets you run a funding simulation starting from the foundation to the selling of the startup. The tool covers various types of funding rounds and options that you can configure. The tool does all the calculations and provides you with a simple breakdown for each funding round. I thoroughly tested this simulator to grasp the norm of modern fundraising. Let’s dive it and see what it offers.

Check out Free AI-based Startup Pitch Script Generator for Entrepreneurs and Free AI Chatbot to Help Startups with Legal Questions.

Free Startup Funding Simulator to Understand Modern Fundraising

This Startup Funding Simulator is hosted on FundingSimulator.com. You can visit the website and create a simulation right away. There is no need for an account or any type of sign-up. The tool has dark and light modes that you can toggle at your convenience. it keeps your simulation progress locally saved in the browser.

The startup funding simulation starts from the top where you can set the number of founders along with their equity. With a simple click of a button, you can add or remove founders and define their equity in the startup.

Funding Rounds

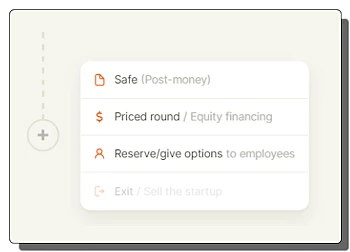

At the time of my testing, this tool covers the following rounds:

- Safe (Post-money)

- Priced round / Equity financing

- Reserve/give options to employees

- Exit (sell the startup)

Safe – Valuation Cap and Discount

A Safe with a valuation cap and discount is early-stage funding. It offers investors protection with a maximum valuation (cap) and rewards with a discounted price per share in the next equity round. You can add one or multiple series of funding in the simulation where you get to set the raised amount, valuation cap, and discount. Alongside each round, the tool gives an equity breakdown among founders. In my simulation, I added 2 safe rounds to understand how the effective valuation is calculated.

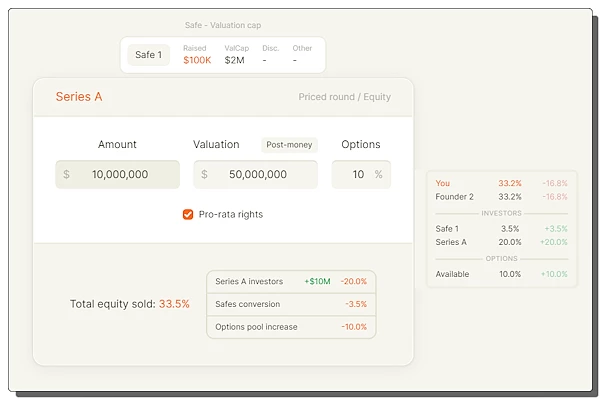

Priced Rounds

Price rounds are where startups sell equity to investors to raise capital. The tool lets you add any number of price rounds into the simulation. You can set the amount, valuation, and options for each round, You can also allow or disallow the pro-rata rights to investors. The tool instantly calculates the total equity sold with a breakdown among investors, safes conversion, and options pool increase. For a price round, the tool shows an equity breakdown among founders, investors, and options. I tried several priced rounds to verify the equity distribution along with the scope of pro-rata rights.

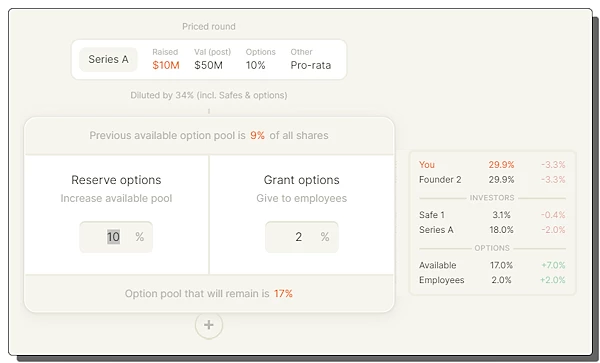

Options

Reserve options are a pool of shares set aside for future equity grants to employees or advisors. On the other hand, Grant options are specific equity grants given to employees with the right to purchase shares at a set price. The option round lets you simulate the reserve options and grant options. Again, the tool shows an equity breakdown among founders, investors, and options.

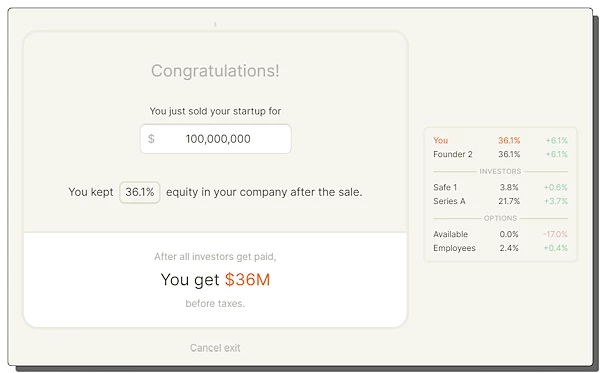

Exit

Exit is where you want to sell the startup and walk away. This step lets you set a selling price for the startup and sell it at that price. After that, the tool shows the amount of equity you kept in the company after the sale. It also calculates how much money (before taxes) you will get after all investors get paid.

Assumptions and Limitations of this simulator

- Only post-money safes and priced rounds

- No down rounds

- No pro-rata caps

- Safes’ pro-ratas disappear after the first priced round

- The remaining available options get redistributed evenly at the exit

Give it a try here.

Closing Comments:

StartupFundingSimulator is a handy tool that helps navigate the complexities of fundraising. It gives a glimpse into the potential outcomes of your fundraising efforts. I find it very educational and informative in terms of the economics and finance of startups. With various fundraising rounds and options, the simulator helps gain insights into the world of modern fundraising, making it easier to plan your funding strategy with confidence.