Open Tax Solver is an open source application meant for US taxpayers to calculate their state and federal income tax returns. If you’re a US citizen you can very easily understand and learn to do your own state tax returns with this simple yet powerful application.

Open Tax Solver is supposed to be used with the Internal Revenue service (IRS) tax booklet that is published annually. This booklet provides detailed information for filing your taxes, such as rules regarding write-offs, tax credits and more.

One of the most difficult aspects of filling tax forms is the math behind it and the calculations that need to be performed. Open Tax Solver takes over this job and cuts down the calculations, thereby simplifying your filing work.

Here are the steps that you need to follow to do your Taxes using Open Tax Solver

1. Download and install Open Tax Solver from the link provided at the end of this article. The application is available for Windows, Linux and Mac systems.

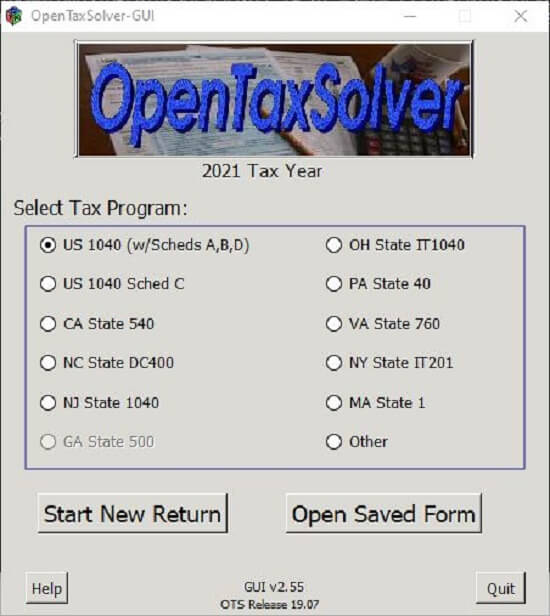

2. Select the Tax program from the choices available. In case you are filing Federal Taxes choose ‘US 1040’, click ‘Start New Return’ and answer the basic questions about your tax situation like deductions, mortgages, and donations etc.

3. If you are paying state taxes, select the correct choice like CA State, NC State etc. and click ‘Start New Return’

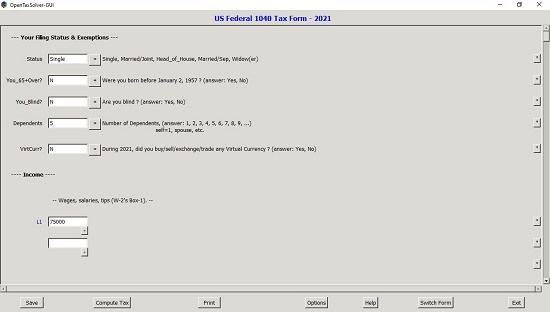

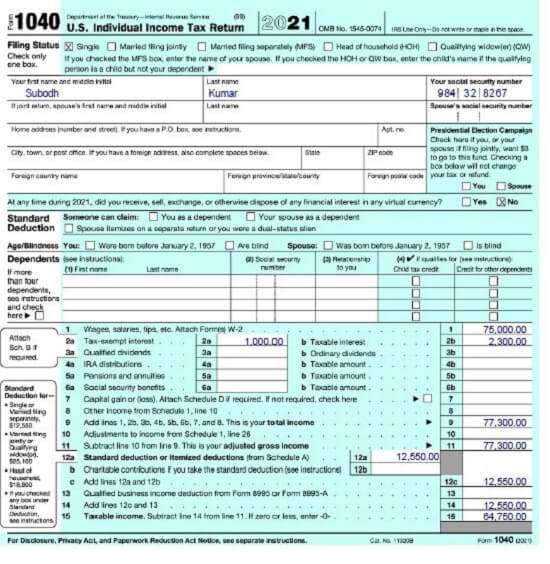

4. In the Next step you need to go through your tax related documents and start filling the data like for example, Income from Wages / Interest / Dividends etc., Capital gains / losses, Tax and Credits and much more.

5. Once all the data is entered and the form is duly filled, you can click on ‘Save’ to save the form and then click on ‘Compute Tax’ on the bottom of the screen.

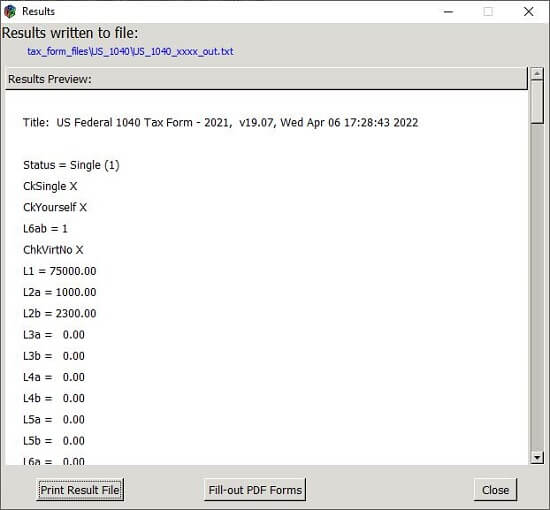

6. If any mistakes have been committed while filling up the form, the application will display an error on the bottom of the ‘Preview’ at the end of the computation.

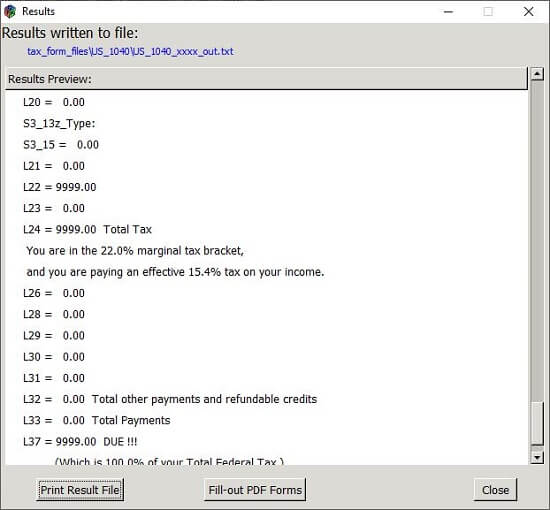

7. The Preview also displays your marginal tax rate and the percentage of your total income that you are paying in taxes.

8. Carefully review all of the information in the Preview screen and make the necessary corrections. Next, finish your returns by clicking on ‘Fill-out PDF Forms’. This will provide you printable tax forms with complete filled-in information. Your Personal Information such as Name, Address, Social Security Number etc. will all appear in the proper places in the form.

9. You can then cross check every single detail in the form and mail it to IRS.

Verdict:

Open Tax Solver gives US Tax Payers a wonderful opportunity to file their own State and Federal Taxes. Apart from this, the software is also a very useful learning tool to enhance ones knowledge about tax related terms and their usage. Open Tax Solver may not have a beautiful and aesthetic interface and the powerful features of commercially available tax applications, but it does a great job in what is really important and that is simply filling out a tax form and filing returns.

Go ahead and download Open Tax Solver from this link and start doing your own tax related work.