In this article we are covering 4 tax websites which let you file a free state tax return online if you qualify for a free federal tax return. Most of the times you have to pay for your state tax returns even if you qualify for a free federal tax return online. Tax websites will let you file your federal tax return for free online is you have a simple 1040 form. But they do not allow you to file the state return for free. They have some conditions or they allow only a few states in their free file policy. Here we are covering some websites which let you file free state tax returns online if you qualify for a free federal tax return, no conditions added to it.

If you qualify for a free federal tax return, than you can also file a free state tax return online. Let’s look at these 4 tax websites to file your state tax return online for free one-by-one.

H&R Block’s Free File

H&R Block’s Free File service is a nice way to file your taxes for free this year. The eligibility criteria for a free federal return can be seen on the homepage of the website. If you qualify for a free federal tax return you can also add a state tax return for free in the website. You can also file both tax returns for free online. You would need to create an account with the website. Once that is done start following the step by step questions which are asked. Enter your personal information first, then add your income, then enter your expenses and credits, health coverage questions. Once you are through with all that you will be taken to your state tax return.

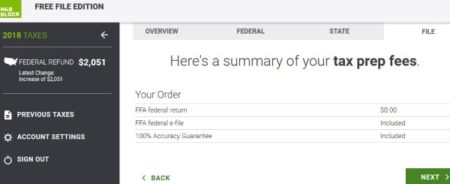

In the state tax return section also you will have to answer questions related to the state you live in. After answering all the questions you will be shown at the end if you are getting a refund from your state or you owe them money. Once you are through with all that, you will be shown if your return qualifies for a free return. If you do then you can choose how you would like to get a refund. You can choose a direct deposit to the bank option, or you can choose to have a paper check mailed to you. Then you will be shown a invoice like the one seen in the screenshot above, which shows you that your return is free. Now you can go ahead and file your return online.

Check out a detailed review of the H&R Block’s website here.

TurboTax Free File Program

TurboTax Free File Program is quite a popular name in the field of online tax filing websites. Its a trustworthy website and is also a part of the IRS free file alliance. The home page of the free file program can be seen above, where it clearly says that all state returns are completely free as well if you qualify. To proceed create an account with the website and login. Then start answering questions as asked by the website. Provide your personal information, then information about your income needs to be entered, followed with information about your expenses and credits. Once done with entering all the information the website process the federal return and shows you a refund amount. After the federal part is completed we move on to the state return part.

In the state return also you will be asked some questions, that you need to answer as they are applicable to you. All the questions are asked in an easy to understand way and help guides are available along with the questions. Once you are done answering the questions, you will be shown a refund summary, in which you will be shown a summary of information you entered and the refund amount which you will get. Moving ahead you will be asked to choose how you would like to receive your refund. Then you will be shown if you qualify for the free return or not. If you do qualify for the free return, then you can go ahead and complete the final steps of the return. Then efile your federal as well as state tax returns online.

Check out a detailed review of TurboTax Free File Program here.

TaxAct Free File

TaxAct Free File is a online tax filing website which also offers free state tax returns if you qualify for the free federal tax return. This website is also a part of the IRS free file alliance. The home page of the free file program can be seen in the screenshot above. To start you return you need to create an account with this website and login. After that you need to start entering information required for tax purpose like personal information, income, expenses, credits, healthcare coverage, etc. Once you are done entering all this information a federal tax summary is shown to you along with the amount of refund that you can expect.

Then we move on to the state tax return section. In this section also, you will be asked some questions about the taxes of the state that you live in. After answering the questions, you will be shown a summary of your state taxes and a refund amount. Next you will be asked to choose how you would like to receive your refund. Now you will be shown if you have qualified for the free file option or not. If you qualify for the free file option, you will see a screen like the one shown in the screenshot above. The screen will show that your return is free. Then you can proceed with the efiling by completing some last steps.

Check out a detailed review of TaxAct Free File website here.

Online Taxes at OLT.com

Online Taxes at OLT.com let’s you file your federal as well as state tax return for free if you qualify the conditions given on their website. Start a return by creating a account on the website. Once you create a account, you will be taken to the personal information section. Fill in all the details about yourself and move on to the income section. In the income section you can fill in details about your W-2 received from the employer, and any other income that you receive. Then move on to the expenses and credits section. After this you will be shown a summary of your federal tax return and the amount of refund that you will be getting.

Then you move on to the state tax filing part. Choose the add a state button and proceed with the state return. Answer questions as they are asked from you. At the end of the state tax section you will be shown a summary of the state tax return. You will also be shown a refund amount if their is a refund due. Then you will be shown if you qualify for a free tax return or not. If you do qualify, then you can move ahead to the efiling option. You can select a PIN number, answer some additional questions, and then you are ready to submit your tax return to IRS online.

Read a detailed review of Online Taxes at OLT.com website here.

Conclusion:

These are the 4 websites which let you file a state tax return online for free, if you qualify for a free federal tax return. You can use any of these websites, they are all safe and trustworthy. Also, all the 4 websites are a part of the IRS free file alliance. The ones which I found to be really good are H&R Block and TurboTax. Both these websites have a great interface which is user friendly. If you are looking to file your state tax return along with your federal tax return, then do try out these websites.