A Home affordability Calculator provides you with a suitable price range for your dream home based on your circumstances. It takes account of all your detailed obligations to figure out if a home is comfortable within your financial reach and also helps you to understand how your expenses and savings figures are affected if you have mortgage debt.

The key factors that a House Affordability Calculator uses to determine how much you can afford on a house are your monthly income, cash reserves that cover your down payment, your monthly expenses and your credit profile (score) which decides how much money you can borrow and the mortgage interest rate you’ll earn.

Most of the home affordability calculators will include interest rate on mortgage that you can expect just in case so that you can have an idea of your monthly payments if they are affordable (within range), stretched or aggressive.

In this article we have listed and briefly discussed 5 Free Home Affordability Calculators that you can use to find out if you can afford a house.

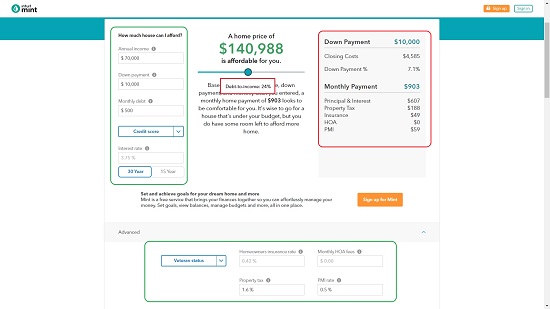

1. Home Affordability Calculator by Intuit Mint

This affordability calculator takes into account your Annual Income, Down payment at the time of buying a home, monthly debt payments, Credit Score and the Mortgage period to calculate the home price that is affordable to you along with an estimate of your monthly payment that is sub-divided into Principal & Interest, Property Tax, Insurance and more.

You can also click on ‘Advanced, and specify the Insurance rate, Property tax (as a percentage of the total home value). Private Mortgage Insurance etc. if you want the calculations to be more precise.

Once your Home Affordability value is displayed, you can use the slider below it to change the value and find out how your Down Payment and Monthly Payment is affected in real time. You can also click and hold the slider to figure out your debt-to-income ratio (DTI) that gives you the ration of how much you owe each month as compared to how much you earn.

Overall, this is a neat and simple House Affordability Calculator that you could use to carefully plan your home and save you any of the risks that arise due to poor planning.

Click here to navigate to Intuit Mint Home Affordability Calculator.

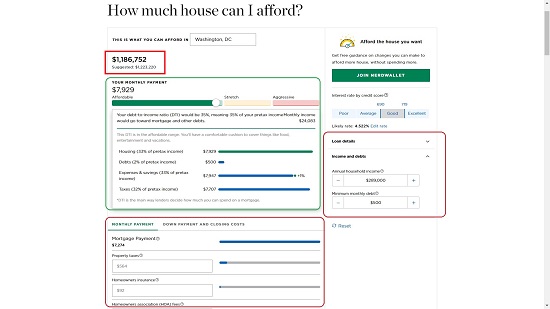

2. Home Affordability Calculator by Nerd Wallet

This is yet another House Affordability Calculator where you can choose the location where you are planning your home.

Just fill your Income & Debts and Loan details using the panel on the left and immediately the Price of the Home that you can afford, along with your Monthly payment that includes Mortgage payment, Property tax, Insurance etc, will be displayed. You can further modify and fill the exact values for Taxes and Insurance if there are any changes.

The color coded horizontal bars give you a precise visual idea and comparison of all the related calculations so that you can be sure of what to expect.

Like the previous calculator, you can use the slider to change the suggested Home value and the Mortgage payment, etc will be recalculated and displayed in real time with an indication if it is in the Affordable zone, Stretched or Aggressive. Your DTI is also displayed below the slider along with its breakup into how much percentage is being spent on housing, debts and more.

All in all, Nerd Wallet Home Affordability Calculator is good and gives you a quick and fair estimate so that you can plan your Home accordingly keeping in mind all the important factors that need to be considered.

To navigate to this Affordability Calculator, click here

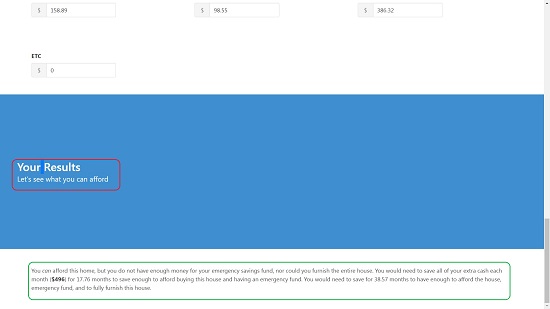

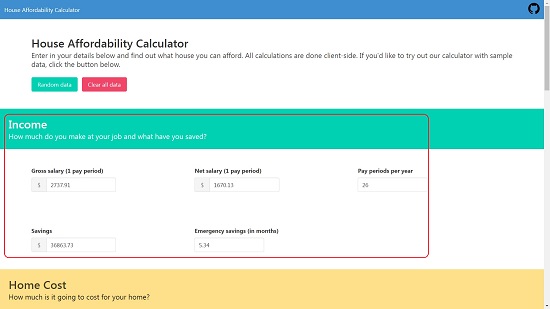

3. House Affordability Calculator by Rezach

This is a more detailed Home Affordability Calculator which captures more information as compared to the ones that we discussed above. Also, it expects you to fill the Price of the Home, Down payment etc and gives the opinion.

The Inputs that you must feed are divided is divided into 4 sections as follows:

Income: Gross Salary, Savings etc.

Home Cost: Price, Down payment, Insurance etc.

Mortgage / Closing Costs: Mortgage length, Rate of interest, Closing costs etc.

Your Budget: Savings, Debts / Loans, House expenses, Groceries etc.

Once you type all the values in the above sections the result is declared at the bottom of the page. You can also click on ‘Random Data’ at the top to test the calculator. The result specifies if you can or cannot afford the home and some risks / advice etc associated with it if you can really afford it.

Overall, this is an okay Home Affordability Calculator but is limited in its flexibility and usage as it only gives a generalized result without displaying you DTI and without any provision of planning and recalculating your monthly payments, etc.

Click here to navigate to this calculator.

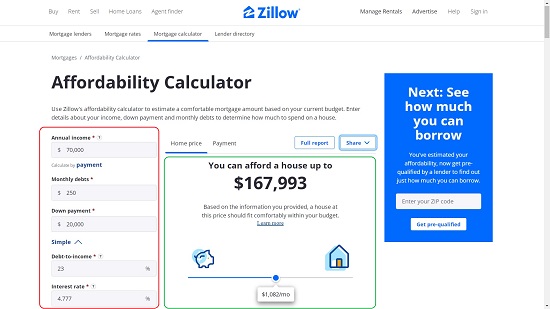

4. Home Affordability Calculator from Zillow

This is the next in line for calculating your Home Affordability from Zillow. The process of calculation remains the same. Simply fill your Annual income, Monthly debts and Down payment and the calculator will give an estimate of what you can afford in housing.

You can use the slider to alter your Monthly payment and update the Home Affordability value in real time. For more detailed calculations, you can click on ‘Advanced, and type the Interest rate, Loan term (in months), Property tax, DTI and more to get precise information about your Home Affordability.

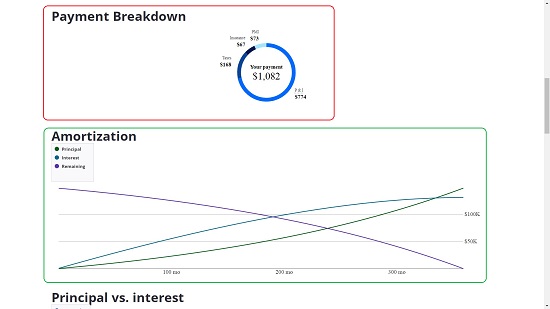

Furthermore, you can click on ‘Full Report’ to get a complete report including pie charts and graphs detailing your Monthly budget, Payment breakdown, Amortization schedule and breakdown etc.

Overall, this seems to be a fine Home Affordability Calculator with an extremely handy and detailed report that you can use for precise planning of your budgets.

Click here to use this calculator from Zillow

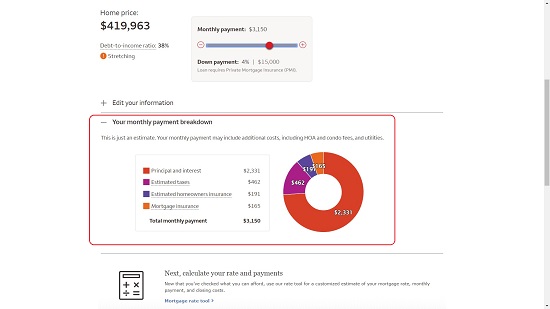

5. Wells Fargo House Affordability Calculator

This affordability calculator is the last in the line in this article. It initially asks you 4 questions regarding your Annual income, Existing monthly Debts, Down payment amount and the Location where you intend to purchase a Home. The calculation takes a couple of seconds at the end of which the estimated Home Price is displayed along with DTI. You can use the slider at the right to alter your Monthly payment and the calculator will update the Home Price in real time along with an indication if the amount is Affordable, Stretching or Aggressive.

You can click on the ‘+’ sign next to Monthly Payment Breakdown to get information on your Principal & Interest, Taxes, Insurance and more along with a Pie chart.

Overall, this is an average affordability calculator with limited flexibility and information.

Click here to visit the Well Fargo Home Affordability Calculator

Since its very crucial to carefully plan your finances and budgets before purchasing a Home, the above listed Home Affordability Calculators can work out to be very handy for you. Go through all of them, perform the calculations and see which one of them offers more flexibility and provision for precise planning. My vote will go for Home Affordability Calculator by Nerd Wallet. You can figure out which one suits you best.