Taxsim is a Free Interactive Income Tax Simulator for US Citizens from 1970 up to the present year.

There is no sign up required and the application interface is very neat and simple.

The user interface of Taxsim has been developed using Vue.Js and Tailwind CSS and all the tax related calculations are based on TAXSIM NBER (National Bureau of Economic Research).

How it Works:

1. Type the Financial Year for which you want to calculate the Income Tax. You can modify the year using the ‘+’ and ‘-‘ signs.

2. Select the US State from the drop down list.

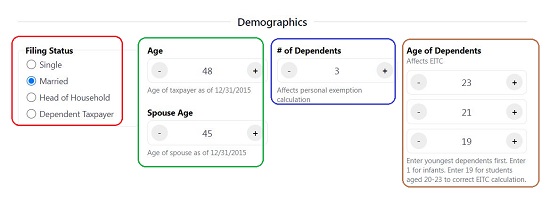

4. Further, under the ‘Demographics’ section, type your Age. You can increase / decrease the year using the ‘+’ and ‘-‘ signs.

5. In case you have selected the Filing Status above as ‘Married, then input the age of your Spouse, Number of Dependents (if any) and their ages.

6. Under the ‘Income’ section, click on ‘Add’ and provide the information about all your sources of Income such as Wages and Salaries, Taxable Pensions and IRA distributions, Self-employment Income, Other Property Income, and more. You can use the Slider or the ‘+’ and ‘-‘ signs to adjust the values. When you have finished supplying all the information, click on ‘Done’

7. Under the ‘Deduction & Credits’ section, click on ‘Add’ supply the details about your applicable Tax deductions and Credits such as Child Care Expenses, Rent Paid, Real Estate Taxes Paid, Itemized Deductions (Home mortgage interest, Motor vehicle registration fees, Charitable contributions etc.) and more. Personal Exemption and Standard Deduction will automatically be included by the Taxsim application based upon your Age, Number of dependents etc. Use the Slider or the ‘+’ and ‘-‘ signs to adjust the values. When you have finished providing all the information, click on ‘Done’

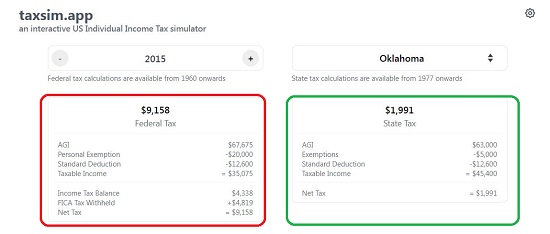

8. When you have completed all the steps above, scroll to the top of the page and you will see your Federal as well as State Taxes will be displayed along with the calculations involved.

Since Taxsim offers real time Simulation, in case you make changes in any of the sections listed above the State and Federal taxes will be automatically reassessed and displayed. In case you are uncomfortable with adjusting the numerical values using the sliders under Income and Deductions & Credits, you can click on the ‘Settings’ icon at the top right of the page and enable the checkbox for ‘Numeric Entry Mode’. This will allow you to type all the values using the keyboard.

Final Comments:

Taxsim is a simple, no-frills Income Tax Calculator for US Citizens that works well and is very easy to use. If you have the all proper information pertaining to Income, Deductions, Credits etc., then you can calculate your State and Federal Taxes in just a matter of seconds.

Click here to navigate to Taxsim and start calculating your Taxes.