So we are discussing tax websites which are part of the IRS free file alliance. Last article we covered 1040.com FreeFileEdition. In this article we will be talking about the online tax filing offered by H&R Block. H&R Block is quite a reputed name when it comes to tax filing. They are also associated with the IRS free file program. That means they also offer a free return if you qualify for their conditions.

The main condition for the free return is that your income for the whole year should be $66,000 or less.

Let’s get started and see how to file tax online for free with H&R Block’s free file:

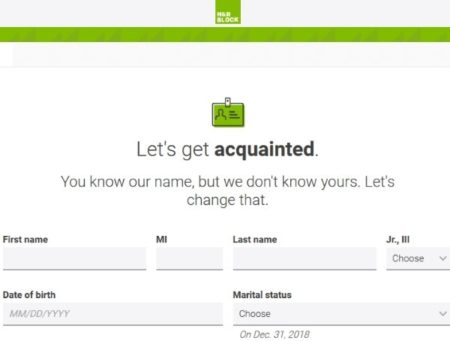

When you land on the H&R Block’s website, you will see a screen like the one shown in the screenshot above. Click on the start for free button. You will be taken to a page where you would be required to create an account. Fill in a username, password, email address and make an account. Once you create an account you will be taken to your dashboard, from where you can start filling in the details as asked.

The step-by-step wizard is really easy to follow. Just answer the questions being asked and avail the help option when in doubt. I liked the interface of this website as the way the questions are being asked sounds very friendly.

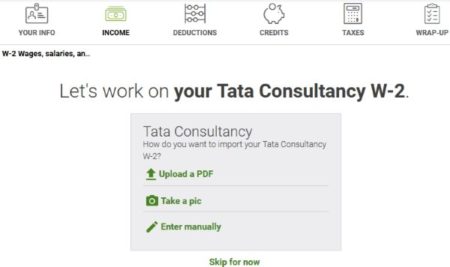

Initially you will be asked to fill in your personal details like name, date of birth, address, marital status, etc. Then you will be asked about your income, that is your W-2 information. Now you can enter your W-2 information in 3 ways. You can either upload a PDF copy, or upload a pic of the W-2, or enter the data manually. Choose how you want to do it and continue with the questions coming up. After this you will be taken through another section to determine if you had any other income apart from your W-2.

Then comes the section for deciding upon deductions and credits. Go through the questions and at the end the website would suggest which deduction you should go with. Go ahead with the standard deduction if suggested. Then your return will be put through a accuracy check and you would be asked some additional questions.

If you have a state return as well, then you can enter your state return information after being done with federal. Remember if you qualify for a free federal return then in some cases you might be able to file a free state return as well.

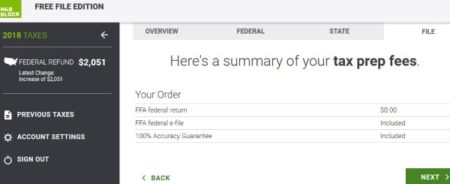

Once everything is ready, you will be shown if you can file this return for free or not. The amount of refund or the amount due will always be visible on the left side of the dashboard. Once it is determined that you will be filing a free return, you will have to decide how would you like to receive your refund. You can get it directly deposited to the bank or you can get a paper check.

You can go ahead and free file your return using the H&R Block website.

Conclusion:

H&R Block is a very popular tax service which is quite trustworthy too. Their online filing service is pretty easy and simple to follow. You can also be sure of your data being secure with this website. So go ahead and check out this website to see if you qualify for the free file program by H&R Block.

Check out H&R Block website here.