Free1040TaxReturns is another good website to consider when filing taxes online this year. This website lets you file tax online for free if you qualify the eligibility criteria given on the website. The eligibility criteria for a free return is if your AGI (Adjusted Gross Income) is $66,000 or less, or you were a active military duty member last year, then you might qualify for a free return. There is also a state restriction, you have to be a resident of the mentioned states to be eligible for a free return. The screenshot below shows you the qualifying criteria for the free return which is also the home page of this website.

Earlier we have covered some other tax websites which offer you free tax returns if you meet their eligibility conditions. The sites which have been covered are 1040.com, H&R Block, TurboTax, TaxSlayer, TaxAct, 1040NOW.NET, ezTaxReturn, FileYourTaxes, FreeTaxUSA, and Online Taxes at OLT.com. You can also try any of these sites to file your tax return. All these websites including Free1040TaxReturns is a part of the IRS free file alliance. So all these websites are safe and trustworthy.

Let’s start with opening the home page of the website, which can be seen in the screenshot below. The link for the website is given at the end of this article.

You can see the eligibility criteria for a free return on this page. To start click the start my free file return button. You will be asked to login to the website by providing a email address, username, password, and adding a security question.

Then we move on to the screen where you would enter your personal information like name, address, social security number, etc. Now you have registered an account with the website. Go ahead and login using the credentials you registered with.

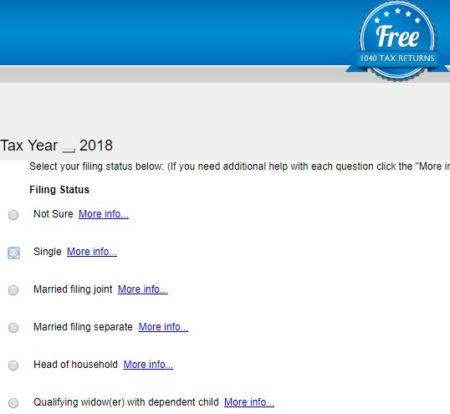

Once you login you will be asked to choose a filing status for yourself. You will be shown all the five filing status that are available, as shown in the screenshot above. Choose the one applicable to you. If you are not sure, then click the more info link given in front of each filing status and you will be guided to choose the right status.

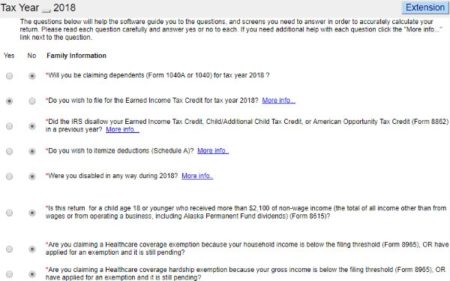

Next you will asked some yes/no questions about dependents, healthcare coverage, etc. This can be seen in the screenshot above. You will also be asked if you want to itemize your deductions. If you select no, then standard deduction would be applied to your return.

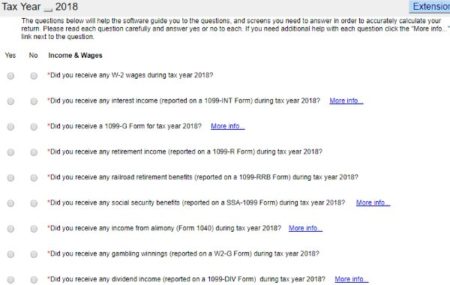

Now we come to the income section, you will be asked some yes/no questions to make sure what all income you had for the year. This can be seen in the screenshot above. You will be asked if you received W-2 income, interest income, dividend income, retirement income, gambling winnings, unemployment compensation, business income, capital gains, etc.

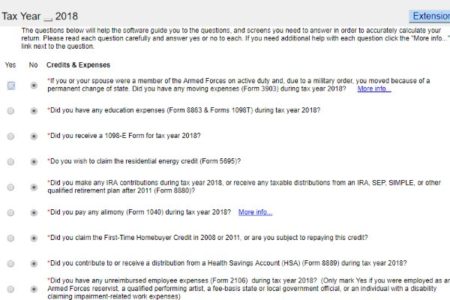

Then you will have to answer some yes/no questions about credits and expenses. This can be seen in the screenshot above. You can check any expenses or credits that you think are applicable to you like education expenses, interest on student loan, alimony paid, IRA contributions, educator expenses, moving expenses, etc.

Now we move on to some information about the state return. Select which state did you live in for the whole or part of the year. Some more personal information needs to be entered now like date of birth, occupation, and phone number.

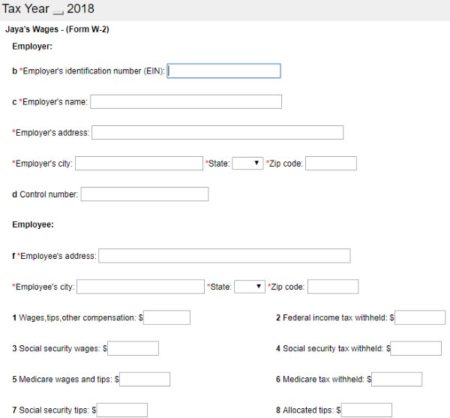

Now that all the questions have been asked, its time to fill in the details. Firstly, select the number of months you were covered by a health coverage plan, then move on to entering your W-2 information.

Fill in the W-2 form as you have received it. After entering information, you will be asked if you have made any additional payments.

You will be asked to enter a state ID information to proceed. Next you will be asked if you want to appoint a third party designee to discuss your return with the IRS, if need be.

More questions about your state tax return would be asked. Once done click the calculate return at the end of this section.

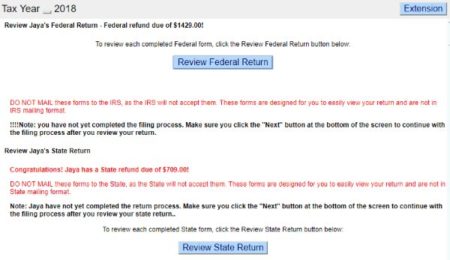

After calculation the website will show you how much refund is due on your federal as well as state tax return. You can review your federal or state tax return from here. But if you are satisfied, then you can move onto the next page.

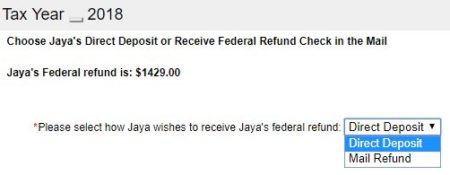

Now you need to choose how you would wish to receive your refund. There are two options, direct deposit in your bank account, or paper check will be mailed to your address. Choose any one of them. Then choose how you want to file your return, do you want to mail in the return or efile the return. If you choose efile then you will be asked about last years AGI or pin that you used last year.

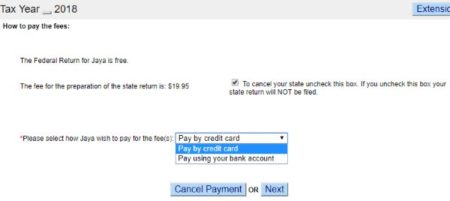

Choose a pin number which will be used as your digital signature. In the example, that we are following in this article, you will be shown that you qualify for the free federal return, but the state return is chargeable. You can file the federal return for free and pay a nominal amount to file your state return. Choose a payment method and click next. Once you have made the payment your return would be ready to be submitted to IRS using the efile option.

Conclusion:

Free1040TaxReturn is a nice website to file your return free this year. The website has a nice interface which is very easy to navigate. The best part of the website is, it will ask you all the questions in the beginning, so that you would not have to enter too much information or go through unnecessary sections. Give this website a try to file your taxes.

Check out Free1040TaxReturn website here.